Let’s talk about the increasing demand and cost of care.

As we are living longer and therefore often longer in poorer health, more & more people will require care. In the year to March 2022 the number of people living in care homes was 360,792, up from 291,000 in 2011.

One in seven are expected to face total care costs higher than £100,000 and one in ten will pay over £120,000, according to the wealth manager Fidelity International. Despite this, very few people will actually plan for these outcomes, reasoning they will deal with this at the time. (Like Wills or powers of attorney)

The subject of care is one that is very rarely discussed or planned for until there is a foreseeable need for it, at which point you are then extremely limited on what options you have to fund or protect what you own. For those who have a Will and believe they are protected – think again! Wills only distribute what you have when you die – care costs impact what you own when you are alive – so will dramatically affect what you leave in your Will.

The average cost of a residential care home in the UK, in 2020, was £37,232 a year. This rose to over £51,896 a year when nursing care was included. In 2022 nursing home fees went up 10% taking the average cost of care to £1,176 a week, or £61,152 a year, according to the Office for National Statistics. With the average length of a stay in a care home for those aged 90 being 2.9 years for women and 2.2 years for men – this would amount to about £177,340 and £134,535 respectively. Below 90 years of age the time & monies spent on care has dramatically increased.

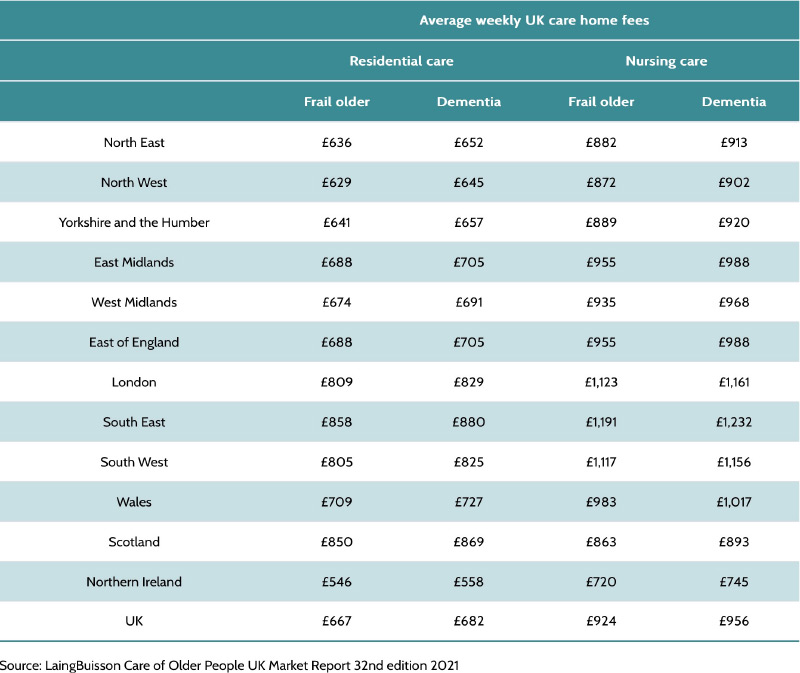

The table below shows how care costs can vary hugely across the country. In addition, the costs of staying in a care home can vary considerably between care homes. For example, the more specialised the care (such as dementia care) the higher the care home fees. You’ll also pay higher care home fees for places with more comfortable surroundings and better-quality facilities, the fees for this type of care can range from £1,300 – £1,800 a week £67,000 – £93,000 a year!

Care home fees are made up of:

- Hotel costs: accommodation, laundry, meals, heating and lighting.

- Care costs: residential care, nursing care, dementia care.

We have to remember, it’s easy to baulk at the weekly cost of what some care can cost but then we have to remember what is actually being provided. Care homes provide care 24 hours a day, 365 days of the year. This gives an average cost per hour of £4.26 for residential care and £5.94 for nursing care.

The Real Cost of Care

It’s easy to look at the yearly cost of care and panic what you own will not last long, the reality is that it’s not as bad as you may think – again this will depend on what care you have and where you live. The trust cost of care is the GAP between the individual’s total income and the cost of care.

If we take the scenario (most likely) that you are or have an elderly parent who is widowed or single and requires care in a home. The cost of care let’s say, is £1,000 a week (£52,000 a year), they own their house worth £450k and have £100k in savings. As they have assets in excess of £23,250 they would be self-funding and would receive no help to cover any costs from the local authorities.

They have a works pension, state pension and a widow’s pension. This gives a total income of £24,000 a year which would leave a shortfall of £28,000 to cover the £52,000 cost of their care. The shortfall is normally taken from savings each year or until the monies are low enough where the house has to be sold to continue paying the fees. It’s easy for these monies to drain down to the levels where local authorities will step in – but this doesn’t have to be the case.

Funding The GAP

A lot of financial providers offer Care Annuities, these are policies that are taken out only when care is needed. They determine how long you will live and then guarantee to fund the GAP until you die for a lump sum. If the GAP was £28,000 and it was agreed they believed you would live for another 6 years – this annuity would cost around £170,000 up front. Once paid, your care would be funded completely from your income and from the annuity until you died giving the reassurance that no other monies over this would be touched.

The downside is if you died before the 6 years then you would lose all monies within the annuity, however, if you lived beyond the 6 years you are quids in! Obviously, the larger the GAP the larger the annuity which gives an element of risk on how much an annuity could cost.

Another alternative is that after the assets have been liquidated, monies could be invested to generate income to actually fund the GAP without touching capital. Specialist advisers and Estate Planners from Foresight can provide Care Plans that offer short term investments over 1-3 years while paying 6-8% annual return.

Based on the example above of a £550k pot of money (after the house is sold), £50k could be left in the bank to cover the first years £28k GAP, with the £500k in a care plan @8% producing an additional £40K a year which after tax – would then continue to fund the care GAP moving forward. If the care lasted more than the care plan it’s simply renewed into a new plan and so on.

The flexibility of using cash to generate an income or an annuity to help fund the difference between an individual’s income and care costs not only allows the level of care to be maintained without involving local authorities, but also and more importantly – the estate is NOT drained, allowing you to make sure there is an estate to leave on death instead of potentially just £23,250.

Summary

The Key to care planning is firstly knowing there are options and actions that can be taken to protect what you own, but only if you want to find out. Most people will plead ignorance when in reality there are solutions if you make the effort to look, minding the GAP is just one of these.

For more information on the above article or questions about Annuities or Care Plans, call Foresight directly to discuss further.